About Us

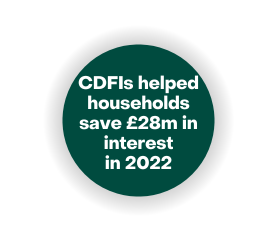

Responsible Finance is the industry body for the UK’s Community Development Finance Institutions (CDFIs) – community lenders driven by their purpose.

We’re here to help you find a lender for personal, business or social enterprise reasons. We don’t provide the finance or make recommendations but we’ll give you the details of our lenders so you can choose which option is best for you.

Our network of members are responsible finance providers, increasing access to fair finance for people and businesses who are often excluded.

Our Personal Lenders

Our lenders understand that everyone needs a loan at some point to spread the cost of anything from a washing machine or holiday to an unexpected bill. They offer loans to people who often can’t get a loan elsewhere, because of the small amounts they want to borrow or their credit history. All our lenders are direct lenders and are not payday lenders.

As a responsible lender they will all take time to check that you have the affordability for the loan you want and some also offer savings products and tools to help you see if you have any unclaimed benefits or grants.

Our Business Lenders

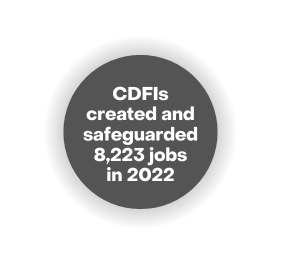

Our lenders help to narrow the finance gap for small and medium size businesses. Using a relationship-based approach, they don’t just look at your financial data, but other data too to take a holistic view of a business.

They:

- Speak with owners and management teams to understand and assess their plans.

- Analyse trading history and decide whether any dip in revenue is temporary.

- Have deep knowledge of their local economies and help customers understand market conditions.

- Do not place unfair limits on lending in certain sectors.

Our Social Enterprise Lenders

As social enterprises themselves, our lenders understand the needs and business models of social enterprises and consider the ‘triple bottom line’ when making lending decisions. They account for positive social and environmental impacts and provide tailored, flexible loan and grant products.

CDFIs focus on businesses excluded or declined by mainstream lenders, including challenger banks and Fintechs. They do not compete with other lenders – their lending is additional, creates future bank customers, and contributes to economic growth through sustainable business growth and innovation that would otherwise have been lost.

To find out more about Responsible Finance go to our website or read our social impact report.